Мебель Молл

Столы и парты

Moll в Самаре

Стол MOLL Unique T8

236,300 руб.

Регулировка по высоте от 69 до 114 см осуществляется с помощью запатентованной системы Express, что позволяет вам работать как сидя, так и стоя. Дополнительно можно установить адаптер высоты (+10 см) и тогда ваш стол Т8 от moll можно будет поднять до 124 см по высоте!

Столешница moll Т8 изготовлена по технологии мультиплекс - это плотно склеенные между собой тонкие листы из берёзы, а покрытие стола - сверхпрочный нано-материал Fenix бежевого цвета

Fenix имеет матовую фактуру, бархатистую на ощупь, и отличается очень низким отражением света.

Такая поверхность стола обладает повышенной устойчивостью к царапинам, шероховатостям, нагреву, кислотно-щелочным растворителям и бытовой химии. Также возможно тепловое устранение микро-царапин. Материал антистатический и антибактериальный, с функцией защиты от отпечатков пальцев, но при этом поверхность легко мыть и нет необходимости в особом уходе. Угол наклона столешницы плавно регулируется до 20 градусов.

Стол MOLL Unique T7 Exclusive

460,200 руб.

Дизайнерский стол с электрической регулировкой высоты для работы стоя и сидя.

Уникальный диапазон регулировки высоты от 56 см до 118 см, с адаптером от 66 см до 128 см.

Электрическое регулирование высоты (электропривод) одной или двумя руками, при необходимости функцию можно отключить.

Интегрированный в стол ящик с разделением на отсеки и местом для хранения письменных принадлежностей.

Столещница 115 см х 75 см / XL 150 см х 75 см, с поверхностным слоем натурального дерева, цветовая/декоративная отделка всегда белая

Встроенный блок розеток и кабель питания.

Встроенные ролики для перемещения стола.

Встроенные выравниватели неровностей пола.

Опоры стола сделаны по принципу телескопа.

Дополнительно зарядка QI Charger

Дополнительно адаптер высоты белый или черный

Передвижной благодаря роликам на ножках

Стол MOLL Unique T7

325,200 руб.

Европейские специалисты по эргономике и ортопеды рекомендуют менять положение тела за столом как можно чаще. Это благотворно влияет на концентрацию внимания и здоровье позвоночника. Теперь разработка немецких инженеров доступна за пределами Германии!

Письменный стол moll T7 создан в первую очередь для взрослых и обладает уникальным диапазоном регулировки по высоте. Высота стола регулируется с точностью до миллиметра под ваш рост - как для положения сидя, так и и положение стоя.

Если Ваш рост более 1.90 м, Вы можете дополнительно приобрести для комфортной работы стоя адаптер высоты, который увеличивает высоту стола на 10 см.

Благодаря быстрой и простой регулировке с помощью электропривода Вы можете настроить стол и для своего ребенка/подростка, если он захочет заниматься за рабочим столом родителей.

Стол MOLL Joker

57,795 руб.

Для отличного старта в школе!

Joker – доступный растущий стол от moll. Это экономичная модель парты-трансформера moll расчитана на широкий круг покупателей. Joker отвечает всем требованиям, которым должен соответствовать фирменный стол от moll. Он растёт вместе с ребёнком за счёт регулировки по высоте, отличается высокой функциональностью и прочностью, но при том прост в эксплуатации, эргономичeн и безопасен.

Стол MOLL Champion Compact

110,916 руб.

Champion Compact от moll - еще больше пространства в детской!

Не каждое помещение, а особенно детская комната, располагает достаточной площадью для установки полноценного рабочего места. Но чтобы и при недостатке места можно было бы воспользоваться всеми преимуществами эргономичной мебели moll для детей и подростков, мы разработали письменный стол Champion Compact.

Он на 30 см меньше в ширину, чем его «старший брат» – письменный стол moll Champion, но при этом в любой момент может быть расширен с помощью дополнений.

Стол MOLL Winner Compact

72,073 руб.

Суперкомпактный письменный стол moll: отличное решение при дефиците места. Небольшой по размерам Winner Compact очень просто превратить в полноценный детский офис с помощью дополнительных мест для хранения и навесных полок.

Стол растет вместе с вашим школьником!

Сконструируйте стол под потребности вашего школьника: выбирайте размер столешницы, ножки, оснащение, декор стола. moll – это максимальная адаптация для максимального комфорта.

Стол MOLL Winner Split

86,488 руб.

Детский стол Winner Split имеет разделённую столешницу с наклонной (2/3) частью.

Стол Winner Split предлагается в трёх декорах: белый, дуб и новинка 2020 года - белый клён. У парты есть возможность выбрать регулировку высоты (Classic или Comfort). Также новинкой 2020 года стало изменение формы столешницы, она теперь имеет скруглённые углы по всему периметру у каждой части.

Стол MOLL Winner

80,067 руб.

Рисовать, мастерить, учиться за своим собственным столом – об этом мечтают даже самые маленькие. С новым столом Winner от moll эта мечта надолго станет реальностью – как минимум до окончания школы!

Отличительная особенность данной программы: модулируемость и конструируемость. Сконструируйте стол под потребности вашего школьника: выберите размер столешницы, ножки, оснащение, декор стола. Со временем рабочую поверхность можно расширять с помощью дополнительных модулей.

Стол MOLL Champion

114,894 руб.

Стол moll Champion стал победителем одного из самых престижных дизайнерских конкурсов – Red Dot Design Awards в 2012 году, который проходит ежегодно в Германии. Высокая награда вручается дизайнерам и компаниям-производителям за выдающееся качество и особые достижения в дизайне товаров широкого потребления.

Мебель Молл

Стулья

Moll в Самаре

Стул Moll S9

209,800 руб.

Стул moll S9 не только обладает всеми преимуществами вращающегося кресла для дома. Это приглашение к движению и переосмысление понятия "стул". Стул moll S9 исключает все компромиссы. Это стул для любой комплекции тела и идеи размещения. Он позволяет больше, чем просто идеальную регулировку под человека.

Благодаря своей форме, он обеспечивает безграничные возможности для своего обладателя. Сидите ли вы прямо, наклоняетесь ли назад или в сторону - подвижная поверхность moll S9 позволяет вашему телу двигаться. Примите приглашение к свободе движения.

Стул Moll S6

91,800 руб.

Каждый из нас индивидуален, точно также индивидуально должно быть и наше рабочее место. Эргономика за рабочим столом начинается со стула. Только тот стул, который можно идеально настроить под себя, оптимально комфортен при сидении. Регулируемый стул moll S6 имеет независимые настройки высоты и глубины сиденья и высоты спинки.

Все механизмы исключительно просты и надежны в эксплуатации. Шестилучевая крестовина обеспечивает стабильность стула. Универсальные ролики подходят как для мягких, так и твердых напольных покрытий. Необычный дизайн роликов придает конструкции стула особую легкость и изящность.

Регулируемый стул Scooter

83,000 руб.

Стильный и функциональный, прочный и безопасный, с высокими эргономическими характеристиками – дизайнерский стул moll Scooter для детей и подростков. Стул Scooter станет отличным дополнением к любому письменному столу moll.

Настраивается индивидуально под рост и пропорции ребенка и прекрасно подходит как первоклассникам, так и подросткам. Независимая настройка по трем направлениям: высота спинки, высота и глубина сиденья.

Регулируемый стул Maximo

57,546 руб.

Стул с уникальными возможностями

- Глубина и высота сиденья, высота спинки регулируются без усилий (имеется шкала).

- Сиденье и спинка специальной формы, особо подходящей для детей.

- Чехлы легко снять и постирать, либо заменить на новые.

- Сиденье оборудовано амортизаторами для лучшей динамики при сидении и большего комфорта.

- Стойка стула оснащена удобной ручкой.

Мебель Молл

Освещение

Moll в Самаре

Настольная лампа Flexlight

35,346 руб.

Гибкая настольная лампа на светодиодах moll Flexlight отлично подстраивается под любые рабочие ситуации благодаря специальной ультрагибкой конструкции. Поэтому ребенок без труда настроит лампу так, чтобы его рабочее место было максимально хорошо освещено и ему было удобно заниматься. Зажимное крепление надежно фиксирует лампу на столе даже при наклонной столешнице. Помимо инновационных функций особое внимание привлекает стильный дизайн.

Регулируемая яркость света

Экономно и долговечно

Меняет цвета

Мебель Молл

Тумбы

Moll в Самаре

Тумба MOLL C7

102,100 руб.

Концепт дизайнерской мебели для дома и работы moll unique был бы не полным без подходящей по стилю подкатной тумбы. Тумба moll C7 по цвету и составу материалов соответствует письменному столу moll T7. Ткани подушки для тумбы сочетаются с подушками регулируемого стула moll S6. Вы можете комбинировать цвета стола, тумбы и стула в одной гамме либо выбрать контрастные сочетания, которые будут идеально дополнять друг друга.

Тумба Cubic

65,111 руб.

Подкатная тумба moll Cubic – вот лучшее дополнение к столу-трансформеру Champion! Тумба запросто помещается под столом, даже если он установлен на самую малую высоту. В качестве удобного аксессуара можно приобрести подушку-сиденье Pad S в нужной расцветке. Красиво и функционально!

Характеристики:

- 3 выдвижных ящика высотой 7, 8 и 9 см с устройством доводчика.

- Два нижних ящика имеют съемные внутренние перегородки.

- Верхнее отделение выполняет функцию многофункционального пенала для хранения канцелярских принадлежностей и мелочей, с тайничком; запирается на ключ.

- Цветные аппликации для ручек 8 цветов.

- 4 ролика с легким ходом, передние ролики имеют фиксаторы.

- Допустимая нагрузка – 75 кг.

- Цвет: белый.

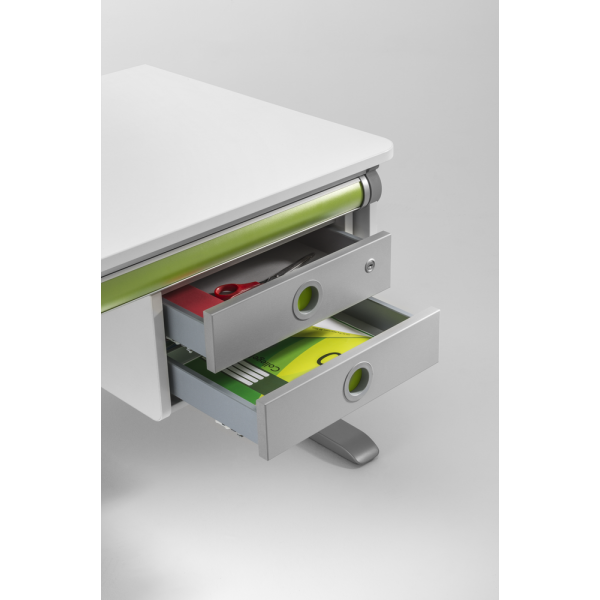

Подвесная тумба Twin Box

38,610 руб.

Подвесная тумба Twin Box с 2 ящиками монтируетсяпод столешницей на выбор: слева или справа. Два компактных ивместительных ящика будут дополнительным местом для хранения канцелярских принадлежностей. Верхний ящик запирается на ключ.

Фронтальная поверхность ящиков выполнена в цвете: белый, белый клен, дуб на Ваш выбор. В комплект входит набор из 6 сменных цветных аксессуаров для ручек (6 цветов). (только для стола Winner)

Тумба Сubicmax

84,582 руб.

Более масштабная альтернатива модели Cubic.

Cubicmax предлагает дополнительный выдвижной ящик и еще два отделения пенала. Оснащен отделениями для канцелярских принадлежностей, которые запираются на ключ. Три выдвижных ящика с доводчиками позволяют хранить документы формата вплоть до А3. Cubicmax оснащен роликами и идет в комплекте с накладками для ручек 8 цветов.

Тумба Pro

54,073 руб.

Три выдвижных ящика с амортизированными доводчиками для предметов вплоть до формата А3. Запираемый на ключ верхний ящик с практичным отделением для мелочей и тайником. Цветные вставки в ручках можно менять – набор из 6 цветов прилагается. 2 ролика с фиксаторами сделают тумбу стационарной. Вместе с подушкой нужного цвета тумба может использоваться как удобный пуф, для совместных занятий за столом.

Вращающийся стеллаж Tower 56

72,540 руб.

Теперь всё под рукой!

Квадратный вращающийся стеллаж с бесшумной опорой и 4-мя полками, которые вы можете регулировать по высоте.

Рекомендованная нагрузка на полку 2 кг. Сам стеллаж выдерживает нагрузку до 50 кг.

По желанию может быть дополнен надстройкой.

Материал: CARB ll с меламиновым покрытием

Мебель Молл

Дополнения и аксессуары

Moll в Самаре

Держатель проводов

2,621 руб.

Закрепите ладошку на краю стола – и вот все провода в железной руке. Этот забавный, но исключительно полезный аксессуар поможет соблюсти порядок: провода не путаются под руками и ногами, не раздражают, не мешают учить уроки.

Подушки для стула Scooter

12,154 руб.

Подушки для стула Scooter легко превратят его в уютное кресло. Они крепятся к сиденью и спинке очень просто – с помощью кнопок.

Подушки для сиденья и спинки можно заказывать подушки разных цветов и видов ткани.

Можно выбрать подушки из гладкой ткани цвета: красный, синий, ярко-розовый, зеленый, серый, страна чудес, галактика, лотта, субмарина.

Можно выбрать подушки из бархатистой ткани цвета: хаки, петроль, лайм, антрацит, магнолия, темный баклажан.

Текстильные материалы экологичны и соответствуют стандарту Oeko-Tex® Standard 100, износостойкие. Стираются при температуре до 40˚ в режиме деликатной стирки.

Глидеры «Стой-на-месте»

3,408 руб.

Для всех стульев moll можно приобрести комплект стационарных заглушек «Стой-на-месте», которые вставляются в ножки стула вместо роликов.

Комплект из шести стационарных опор-заглушек. Вставляются в ножки стула вместо роликов. Комплект «Стой-на-месте»заказывается дополнительно.

Материал:полимер черного цвета, сталь.

Подушки для стула S6

14,600 руб.

Эргономика в сочетании с цветовыми акцентами: подбирайте подушки по своему вкусу, комбинируйте цвета спинки и сиденья или выбирайте все в одном цвете.

Мягкие и удобные подушки для сиденья и для спинки ( приобретаются отдельно) тринадцати привлекательных расцветок станут удачным дополнением для стула S6.

Подушки изготавливаются только из материалов высокого качества и отшиваются вручную.

Ткани Uni ворсистые, мягкие и теплые на ощупь, влагоотталкивающие и прочные для интенсивного использования.

Ткани Ribcord - вельвет с широкими продолными рубчиками в современных цветах.

Накладки на стол

3,670 руб.

Детское рабочее место часто напоминает настоящую мастерскую: здесь рисуют, лепят, вырезают, клеят — работают с самыми разнообразными материалами и инструментами. Именно поэтому накладка на стол — это удобная и практичная деталь для детского рабочего места, которая прекрасно защитит поверхность стола во время творческих занятий ребенка. Нижняя часть накладки изготовлена из губчатой резины, что предотвратит соскальзывание даже при наклонной столешнице.

Мальчикам наверняка понравится рисунок с пиратами, а девочкам — с принцессой. А перед "Картой мира" со множеством интереснейших деталей не смогут устоять даже взрослые!

Накладка на стол сделана из высококачественных материалов, подходит для всех моделей moll.

Размер (ВxШ): 60 х 42 см

moll — немецкое качество в каждой детали!

Линейка

3,014 руб.

Линейка moll это больше, чем помощь в выведении прямых линий. Она оснащена лупой и ее внутренний магнитный слой предотвращает соскальзывание с наклонной поверхности.

Orga Set

2,752 руб.

Бокс Orga Set для канцелярских мелочей со встроенной точилкой и скотчем удобно разместить на столе или в выдвижном ящике стола или тумбы.

Размер (ВxШхГ): 5 х 23 х 17 см

moll — немецкое качество в каждой детали!

Подставки для книг Basic

6,290 руб.

Если учебник размещен на подставке для книг, это способствует поддержанию правильной осанки во время занятий. Книга находится на оптимальном расстоянии от глаз, к ней не придется наклоняться или придерживать ее рукой.

- Подставка для книг складная (при покупке стола Champion – в комплекте). Мобильную подставку для книг можно запросто сложить и захватить с собой в школу.

- Подставка для прозрачная книг (при покупке стола Winner, Joker – в комплекте). Четыре в одном: подставка для книг, держатель расписания, трафарет и лупа. Прикрепленная к столешнице, подставка не упадет даже при ее подъеме.

Карман Utensilo behind

10,091 руб.

Карман Utensilo для мелочей на панель от фабрики moll

Удобно и креативно! На липучке карман крепится на панель к столу Champion или приставку к столу Champion или Winner. Цвет выбирается в соответствии с предпочтениями ребенка красный, синий, ярко-розовый, черный, зеленый, оранжевый или серый. Стерки, ручки, карандаши, точилки, записки и стикеры, все это теперь удобно разместится в кармане со множеством отделений. Вот так не навязчиво и с интересом ребенок развивает в себе организованность!

Карман Utensilo beside

7,863 руб.

Карман Utensilo для мелочей на панель от фабрики moll Удобно и креативно! На липучке карман крепится на панель к столу Champion или приставку к столу Champion или Winner. Цвет выбирается в соответствии с предпочтениями ребенка красный, синий, ярко-розовый, черный, зеленый, оранжевый или серый. Стерки, ручки, карандаши, точилки, записки и стикеры, все это теперь удобно разместится в кармане со множеством отделений. Вот так не навязчиво и с интересом ребенок развивает в себе организованность!

Крючок для портфеля

394 руб.

У мебели moll портфель также имеет свое твердое место у письменного стола. Крючок для портфеля можно гибко "навешивать" в сторонах столов. Таким образом домашние задания находятся в любое время рядом.

Подушка Pad

18,323 руб.

Подушка-сиденье для тумб Cubic и Pro. Превращает тумбу в удобное дополнительное посадочное место. А большой выбор ярких цветов украсит дизайн комнаты и поможет задать отличное настроение.

Подушка для тумбы из высококачественного поролона со съемным чехлом, который легко стирается при температуре 40°С. Оснащена антискользящим покрытием. Толщина подушки 4 см. Чехлы 15расцветок и два варианта ткани на выбор.

Размер: Д 43 × Ш 54 × В 4 cм

QI-Charger беспроводная зарядная станция

9,000 руб.

Cтолы Champion, выпускаемые с мая 2018 г. можно укомплектовать беспроводной зарядной станцией QI Charger.

Место для зарядки указано на столешнице значком Q

Приставка Panel Champion

27,612 руб.

Расширение рабочего места moll Champion.

Интерактивная двусторонняя задняя стенкa: черная сторона («классная доска») для работы мелками, белая – водорастворимыми маркерами, обе стороны магнитные.

Размер (ШхВхГ): 120 х 6 x 25см.

moll — немецкое качество в каждой детали!

Приставка Flex Deck Champion Compact

59,319 руб.

Дополнительная опция для стола-трансформера moll Champion Compact. Мультифункциональная вертикальная стенка, монтируется с задней стороны стола. Оснащена 2 горизонтальными полками, 1 магнитной доской, обтянутой тканью. Стенка Flex Deck – это просто находка рабочего места в небольшом помещении!

Размер (ШхГхВ): 90 х 30 х 67см

moll — немецкое качество в каждой детали!

Приставка Side Top

23,283 руб.

Навесная боковая приставка для стола moll Champion. Расширяет рабочую поверхность стола.

Характеристики и основные детали:

- Крепится двумя кронштейнами к боковине стола на нужной высоте;

- Левый/правый монтаж;

- Цвет: белый.

Крышка для кабель-канала

3,042 руб.

Дополнительная опция для стола Champion. Крышка для кабель-канала выполнена из полупрозрачного пластика с эффектом матового стекла, закрывает содержимое кабель-канала.

Приставка Multi Deck Champion

22,932 руб.

Навесная задняя панель – расширяет рабочее пространство для размещения TFT-монитора или хранения книг. Приставку можно установить на нужный уровень для эргономически правильного размещения монитора. Обеспечивает оптимальное расстояние от глаз до экрана.

Характеристики и основные детали:

- Навесная задняя приставка (без опоры).

- Держатель монитора с регулируемым углом наклона, регулируемая высота полки – для установки монитора в эргономически верное положение.

- Комбинируется с боковыми приставками.

- Цвет: белый.

- Не комбинируется с задней полкой Flex Deck.

Приставка Side Top Winner

18,252 руб.

Расширяет рабочее пространство стола. Боковая навесная полка Side Top для письменного стола moll может монтироваться на различной высоте как с левой, так и с правой стороны стола.

Размер: 40х71 см.

moll — немецкое качество в каждой детали!

Приставка Side Top Champion

23,283 руб.

Дополнительная опция для растущей парты moll Champion Compact. Боковая полка Side Top монтируется слева и/или справа и используется как дополнительная горизонтальная поверхность. Увеличивает ширину стола на 40 см. Может быть установлена на различной высоте.

Размер (ШхГ): 40 х 72 см

moll — немецкое качество в каждой детали!

Приставка Flex Deck Winner Compact

59,670 руб.

Многофункциональная вертикальная стенка Flex Deck Compact для детского растущего стола moll расширяет рабочее пространство. Оснащена полкой, двумя магнитными досками с набором сменных цветных накладок, планками с крючками и лотком для мелочей. Полка нейтрального серого цвета снабжена двумя угловыми ограничителями.

Размер (ВxШxГ): 63x91x28 см.

moll — немецкое качество в каждой детали!

Приставка Flex Deck Winner

63,180 руб.

Многофункциональная вертикальная стенка Flex Deck.

Цвет полок: серые под алюминий.

Размеры: 121x28x67 см.

moll — немецкое качество в каждой детали!

Подушка C7 Pad

21,900 руб.

Подушка-сиденье для тумб C7 с антискользящим покрытием. Превращает тумбу в мобильный пуфик.Чехол на подушку доступен в 14 разных цветах, которые сочетаются с расцветками чехлов стульев. Наполнитель подушки из высококачественного пеноматериала толщиной 4 см. Чехол легко чистится при 40 градусах С. Размер: Д 44 × Ш 54 × В 7 cм

Выдвижной ящик Champion

22,230 руб.

Дополнительная опция для стола Champion.Выдвижной ящик на всю ширину стола – практичное место для хранения школьных принадлежностей. Можно купить отдельно, при установке демонтаж стола не требуется. В комплекте с выдвижным ящиком – вкладки из поролона для предотвращения скольжения ручек и карандашей.

Выдвижной ящик Champion Compact

19,773 руб.

Опция для детского письменного стола moll Champion Compact.

Практичное и вместительное место для хранения предметов на всю ширину стола. Оснащен вкладками из поролона.

Крышка на ящик Champion Compact

12,056 руб.

Опция для детского письменного стола moll Champion Compact.

Крышка для выдвижного ящика защищает содержимое ящика от пыли и выполняет эстетическую функцию при поднятой столешнице.

Крышка для кабель-канала Champion Compact

2,457 руб.

Опция для стола moll Champion Compact.

Крышка для кабель-канала выполнена из полупрозрачного пластика с эффектом матового стекла, закрывает содержимое кабель-канала.

Приставка Multi Deck Winner

20,709 руб.

Расширяет рабочее пространство стола. Задняя навесная полка Multi Deck для письменного стола moll оснащена практичным ограничителем для поддержки монитора или книг. Устанавливается на различной высоте.

Размеры: 116*22*17 см.

moll — немецкое качество в каждой детали!

Приставка Side Top Joker

15,444 руб.

Расширяет рабочее пространство стола. Боковая навесная полка Side Top для письменного стола moll может монтироваться на различной высоте как с левой, так и с правой стороны стола.

Размер: 40х68 см.

moll — немецкое качество в каждой детали!

Приставка Flex Deck Champion

59,319 руб.

Многофункциональная вертикальная стенка Flex Deck. Конструкция состоит из полки с двумя угловыми дугами-ограничителями, поперечных планок с магнитными досками для крепления записок, фотографий; лотком для хранения дисков; крючков для флешек, ключей, брелоков и прочих мелких предметов. Ваш ребенок может использовать стенку как для хранения книг, так учебников и других школьных принадлежностей.

Характеристики и основные детали:

- Крепится двумя кронштейнами к опорной раме с задней стороны стола.

- Оснащение: 2 полки (белые) для книг и одна магнитная доска, обтянутая тканью с магнитами. Можно крепить карман Utensilo для мелочей и канцтоваров. (Приобретается отдельно).

- Цвет: белый.

- Не комбинируется с другими задними приставками.

- Установка высоты стола с приставкой от 56 см.

Крышка на выдвижной ящик Winner / Champion

14,677 руб.

Крышка на выдвижной ящик – оптимальная защита от пыли и любопытных взглядов

Выдвижной ящик Joker

13,104 руб.

Вместительный выдвижной ящик для столаJoker. Помогает поддерживать порядок на рабочем месте; располагается во всю ширину стола.

Крышка на выдвижной ящик Winner Compact

12,056 руб.

Крышка на выдвижной ящик – оптимальная защита от пыли и посторонних взглядов при поднятой столешнице.

Выдвижной ящик Winner

17,082 руб.

На всю ширину стола, вместительный и устойчивый. Поддержать порядок поможет рифленый поролоновый вкладыш, чтобы предметы не скользили, и перегородка для отделений. С фронтальной стороны расположен вместительный лоток для ручек и карандашей.

Приставка Multi Deck Winner Compact

20,592 руб.

Расширяет рабочее пространство стола. Задняя навесная полка Multi Deck Compactдля письменного стола moll Winner Compact оснащена практичным ограничителем для поддержки монитора или книг. Устанавливается на различной высоте.

Размер: 86x22*17см

moll — немецкое качество в каждой детали!

Надстройка для Tower 56

40,950 руб.

Надстройка позволяет увеличить стеллаж Tower 56 по высоте до 126 см., что позволит удобно хранить больше различных предметов. Предельно допустимая нагрузка на каждую полку - 2 кг.

Материал: CARB ll с меламиновым покрытием

Мебель Молл

Каталог мебели Молл в Самаре от официального дилера Moll

Moll в Самаре

В нашем каталоге товаров представлена информация по мебели молл коллекции PRIME и UNIQUE. Вся мебель для детей парты, стулья, дополнения и аксессуары есть в наличии. С моделями столов и стульев можно непосредственно познакомиться на нашем шоуруме по адресу ул. Маяковского, 89. На нашем складе мы регулярно поддерживаем остатки большого ассортимента товара moll, это не только столы, стулья и освещение, но и расширения, тумбы молл и аксессуары. Под заказ готовы привести за короткие сроки мебель профессиональной серии, серии 360* и серии EASY.